Malaysia Hotline: +603-2141 8908

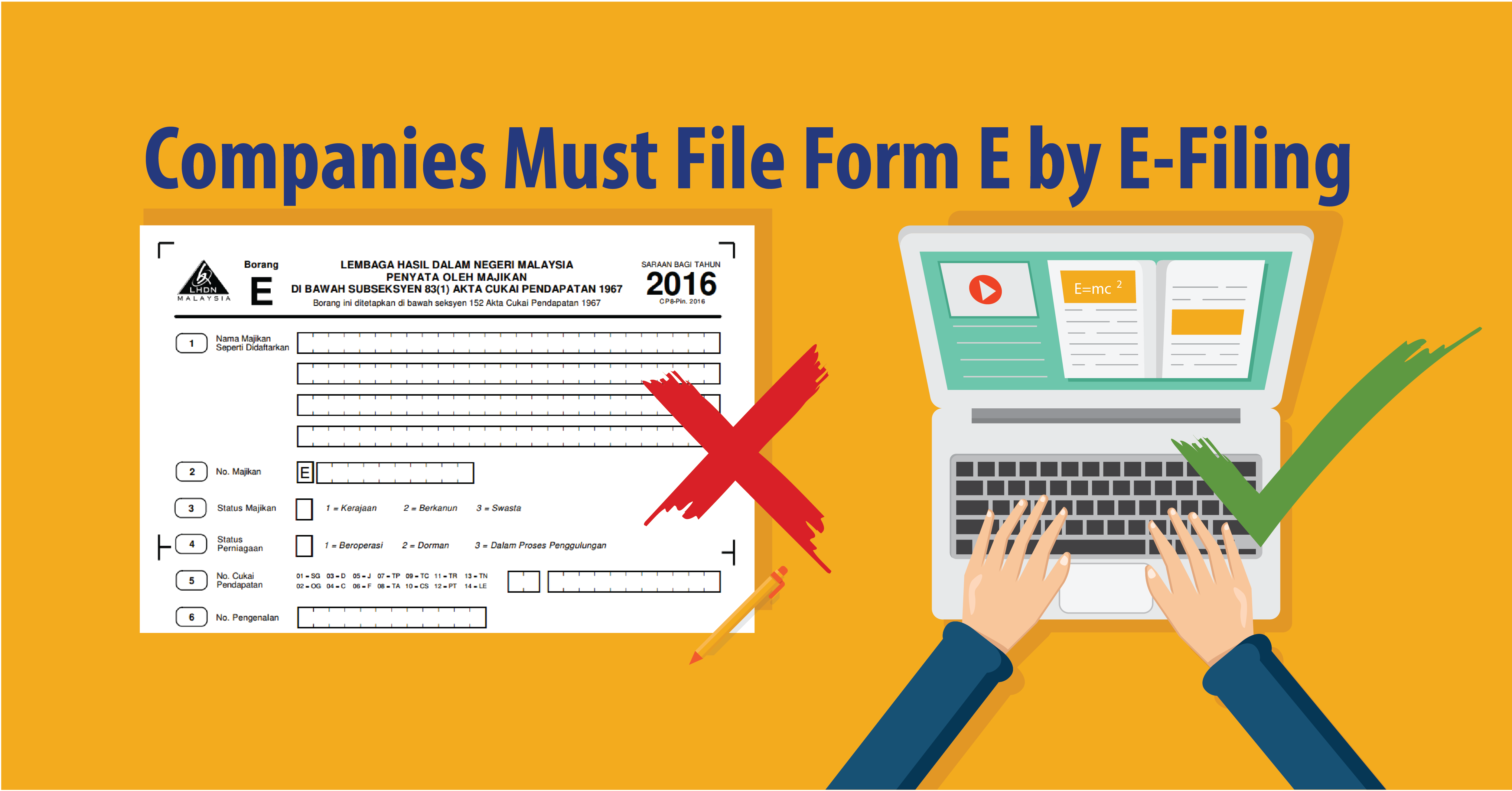

In Malaysia, regardless of

the size of your company's business, wholly-owned companies, dynamic or static

companies, and companies that do not hire employees must submit Form E.

Form E is that domestic

business people report the latest business status to the Tax Bureau. Employers

must submit a statement of details such as the size and salary and expenditure

of the whole year to the Tax Bureau.

At present, some small

enterprises in Malaysia do not submit Form E to the Tax Bureau in order to

reduce the trouble. In fact, the submission of the form E does not result in a

loss to the employer. It is only a form submitted. Once the Tax Bureau found

out that it was not submitted within the time specified by the Tax Bureau, the

employer must pay the fine imposed by the Tax Bureau.

1. Deadline for Submitting Form E

|

Submission Method

|

Deadline for submitting Form E

|

Grace Period

|

|

Company

|

Non-company

|

|

Online Submission

|

March 30 of each year

|

March 30 of each year

|

One month (to April 30 of each year)

|

|

Manual submission: by mail

|

Not available and invalid

|

March 31 of each year

|

Within 3 working days

|

|

Manual submission: on site

|

Not available and invalid

|

March 31 of each year

|

None

|

* Employers need to pay

attention to these deadlines

2. Company That Needs to Submit

Form E

Either Sole Proprietor,

Partnership, Private Limited, Dormant Company must submit Form E by March 31 of

each year. Start from the year of 2014, all Dormant Companies or Companies

without any employees are required to submit Form E.

3. Fine

The employer must submit

the complete Form E to the tax bureau within the specified time. If some employers

are failed to comply with the regulations, the Tax Bureau will impose a fine on

the company. Offenders will be convicted under the Income Tax Act (ITA) 1967

Act and may be fined between RM200 and RM20, 000 or imprisoned for up to six

months.

4. Submission Methods

The employer can download

the Form E from the website of the Tax Bureau, and then fill it out and submit

it to the Tax Bureau directly. Employers can also use the electronic platform on the website of

the Tax Bureau for submission. In addition, tax consultants from Tannet can provide services for

submitting Form E on behalf of employers.

5. Form EA

Form EA is a salary profile

that employers must issue to employees, it including income for one year,

withholding tax (PCB) and other benefits. Form E and Form EA are related. The content of the Form E comes

from the Form EA that the employer issued to the employee. The employer does not have

to submit the Form EA to the Tax Bureau, but it must be issues to the employee

on or before February 28 of each year.

If you want to submit the Form

E, Tannet can handle and help you, because Tannet is familiar with the forms

and other matters of the Tax Bureau and can provide you with a tangible

solution. For further enquiries,

please feel free to call the Tannet Service Hotline at 603-2141 8908 or email

tannetmy@gmail.com. Malaysia Company Address: Unit 6.06, Level 6, Amoda 22, Jalan Imbi 55100 Kuala Lumpur.