Malaysia Hotline: +603-2141 8908

Labuan is located in eastern

Malaysia and also one of the Federal Territories of Malaysia. Located in the

heart of the Asia Pacific region, Labuan is strategically positioned to reach

one of the fastest growing regions in the world, creating an excellent

opportunity for companies to connect with Asia and other economies. Malaysia's

Labuan International Business and Finance Center has a good partnership with

countries around the world. As ASEAN will formally form the ASEAN Economic

Community (AEC), it will become the seventh largest economy in the world. Then,

the “One Belt, One Road” strategy advocated by China has further accelerated

economic growth in Asia and brought tremendous opportunities for cooperation

among countries in the region.

Labuan

Corporate Tax Overview

1. Double Taxation Agreement

(DTA)

Generally, zero-tax overseas

registered countries such as BVI or Cayman have no way to sign a double

taxation agreement with any country, commonly known as the DTA (Double Taxing

Agreement). The advantages like Labuan are rare in the world. Labuan's 3% net

profit and RM20,000 fixed tax amount indirectly maintain its flexible strategy

in the double tax agreement. Moreover, the holding company does not need to pay

taxes in Labuan, and Greater increase in the attractiveness of Labuan. To

further protect entrepreneurs, Labuan did not claim to be Tax Haven, but the

Strategic Tax Planning Centre.

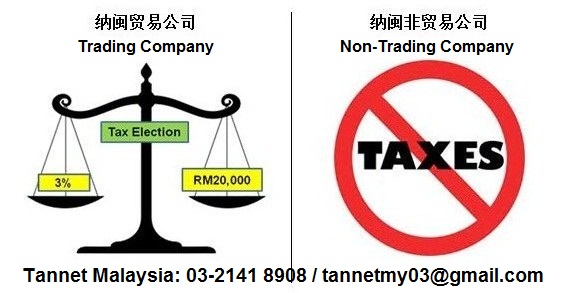

2. Excellent Tax Benefits

-

Labuan

non-trading company: This type of business activity is tax exempt under

the tax regulations of Labuan;

-

Labuan

trading company: business activities other than holding investment, such

as: trade, consulting management, insurance trust, etc., can choose to pay

3% corporate profits tax, but must submit annual audit report; or pay

annual tax of RM 20,000, but exempted from submitting annual audit report;

-

For

companies who have business with Malaysian companies, a 25% corporate tax

must be paid (not recommended);

-

No

stamp duty, value added tax, consumption tax, service tax, withholding

tax;

-

Without

foreign exchange controls, company funds can be flow freely.

All Labuan's financial year ends

on December 31 of each year. Companies that choose to pay a 3% corporate

profits tax must prepare financial statements and audit reports to the

Malaysian Taxation Office. Companies that choose to pay an annual tax of RM

20,000 do not need to prepare audit report. Labuan companies must maintain

financial statements, complete audit reports, submit annual returns, tax

returns, E forms and forms BE (if applicable) in accordance with the

requirements of the Labuan Administration to complete the annual compliance

process.

Contact Us

If you have further queries,

please contact Tannet

24 hours Malaysia hotline:603-21418908;

24 hours Hong Kong hotline:852-27837818;

24 hours China hotline:86-755- 36990589;

Email: mytannet@gmail.com

TANNET GROUP:

http://www.tannet-group.net , http://en.tannet.com.my