Malaysia Hotline : +603-2141 8908

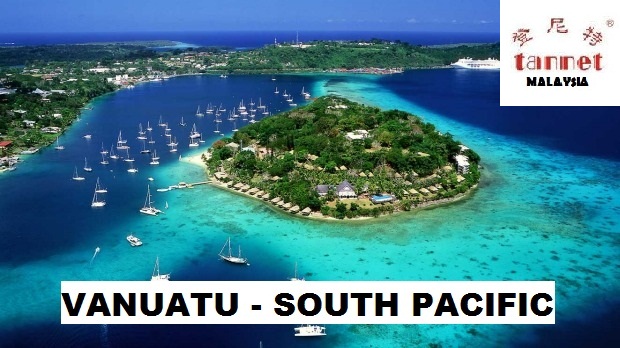

Vanuatu company formation is also called Vanuatu business setup, Vanuatu company registration and Vanuatu corporate formation, etc. Vanuatu is a Pacific island nation located in the South Pacific Ocean. The archipelago, which is of volcanic origin, is some 1,750 kilometres, east of northern Australia, 540 kilometres northeast of New Caledonia, east of New Guinea, southeast of the Solomon Islands, and west of Fiji.Vanuatu was first inhabited by Melanesian people.

Why choose a Vanuatu company?

(1) Only one shareholder (can also be a legal person, no nationality restriction or residency restrictions);

(2) Only one director (can also be a legal person, no nationality or residency restrictions);

(3) Beneficial owners’ details won’t be shown on the public record;

(4) Vanuatu International Companies are tax exempt from all forms of taxation in Vanuatu;

(5) The directors and the shareholders meetings do not have to be held in Vanuatu and there are no requirements for Annual General Meetings.

Requirements on Vanuatu company

1. Company name

Company name is subject to the following requirements and restrictions: A name can be in any language as long as Roman letters are used. The Registrar may however require an English translation if a foreign language is used to ensure that the proposed name is not a restricted name.A name cannot be identical or similar to that of an existing company.The following words or their derivatives may not be used unless the relevant licenses have been obtained: bank, chartered, establishment, foundation, insurance, partnership or trust.Must end with Limited of Ltd to denote limited liability.

2. Capital Structure

No concept of authorized share capital may be limited by shares, guarantee or both shares may be paid up in cash or through the transfer of other assets or for other consideration. The minimum issued number of shares is one bearer shares are permitted.

3. Corporate Structure

(1) Only one director required - can be corporate.

(2) Only one member required - can be corporate Member(s) and director(s) may be the same.

(3) No requirement for local member(s) and director(s) for Vanuatu Companies.

(4) No secretary is required.

Taxation in Vanuatu

There is no income tax, no withholding tax, no capital gains tax, there are no inheritance taxes, and no exchange controls associated with the Vanuatu International Company.

Vanuatu Company Accounting

Vanuatu companies are required to maintain financial statements, accounts or records. They are not required to file financial statements, accounts or records with the local authorities. The company register must be kept at the registered office. There are no requirements to file an annual return for a Vanuatu Company.

Contact Us

If you have further queries, please contact Tannet

24 hours Malaysia hotline:603-21418908;

24 hours Hong Kong hotline:852-27837818;

24 hours China hotline:86-755- 36990589;

Email: mytannet@gmail.com

TANNET GROUP: http://www.tannet-group.net , http://en.tannet.com.my